how to pay meal tax in mass

In fiscal 2012 826 million was collected by municipalities through the local meals tax 78 percent of the potential 1058 million that could be raised if the tax were in effect in. 205 210125 2260125 which is rounded to 22601.

C D L Vehicle Groups And Endorsements Trucking Life Cdl Trucks

Hotels bread and breakfasts and other lodging businesses might also see relief.

. Thirty-five of the 50 cities do not charge a higher tax on meals than on other goods. Clothing has a higher tax rate when you spend over 175and a special local sales tax of 075 may apply to meals purchased in some localities. Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7.

Lets start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Massachusetts. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

All taxpayers may file returns and pay tax due for Meals and Rooms Tax using myVTax our free secure online filing site. Also on August 1 the sales tax exemption currently in effect for beer wine and alcohol sold in package stores will be lifted and those items will be taxed as well at 625 percent. Visitors to Minneapolis Minnesota pay the highest meals tax.

This new rate will also apply to the sale of automobiles. Business purchases for resale are also exempt with the use of a Sales Tax Resale Certificate Form ST-4 completed by the buyer. Follow this link httpsmtcdorstatemausmtc to come to this screen.

A combined 10775 percent rate. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. More Information including how to pay past due bills online can be found here.

As a meals tax vendor you must add a 625 sales tax and where applicable the 75 local option meals excise to the selling price of every taxable transaction and collect it from the buyer. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The tax comes to about 37 cents for every 50 spent on a restaurant meal.

52 rows The table below lists the sales tax and meals tax in the 50 US. What transactions are subject to sales tax. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Beginning August 1 the sales tax and the meals tax will increase from 5 percent to 625 percent. Once youve found the correct sales tax rate for your area you need to figure out how much to charge each customer on their purchases. Some Massachusetts restaurants and bars are getting a bit of a reprieve in a time of financial uncertainty brought on by the novel coronavirus pandemic.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Use the sales tax formula below or the handy calculator at the top of the page to get the tax detail you need. The tax must be separately stated and separately charged on all invoices bills displays or contracts except on those solely for alcoholic beverages.

Massachusetts Department of Revenue DAIGO FUJIWARA TOM. Commonwealth of Massachusetts Massgov is a registered service mark of the Commonwealth of Massachusetts. First convert the percent into a decimal value of 01025.

Businesses register to collect meals tax with MassTaxConnect. The Division of Local Services estimates the revenue that each municipality could receive from the local meals tax based on state meals tax revenue that is already being generated in the community. A special sales tax on alcoholic beverages was repealed in 2010.

Cities with the highest population. FAQs on New May 17 2021 deadline Mass. Then the amount of the sales tax is calculated as follows.

Excise Tax current bills only In Person. Massachusetts Restaurant Tax. This page describes the taxability of food and meals in Massachusetts including catering and grocery food.

Be sure to check if your location is subject to the local tax. Vendors must add a 625 sales tax to the selling price of every meal and collect it from the purchaser. If you pay Meals and Rooms Tax for multiple locations the Commissioner of Taxes has mandated that you must file and pay electronically.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Businesses that collected less than 150000 in room occupancy taxes in. To learn more see a full list of taxable and tax-exempt items in Massachusetts.

617 626-2300 or write to us at PO Box 7010 Boston MA 02204. How can that be calculated. Of Rev 03232021 Do you have to pay sales tax on meals in Massachusetts.

In MA transactions subject to sales tax are assessed at a rate of 625. Massgov Javascript must be enabled to use this site. Charlie Baker announced today that emergency regulations are being finalized this week to allow small businesses to push back payment of several taxes until June including meals taxes.

The Massachusetts tax on meals sold by restaurants is 625 this is true for all cities and counties in MA including Boston. This must be collected from the purchaser and separately stated and charged on. DORs customer service call center hours for tax help are 9 am - 5 pm Monday through Friday.

That value will then be added to the before-tax price to arrive at the after-tax price as follows. Taxpayers who have already filed their personal income tax returns but have not made the associated payment will have until May 17 2021 to make the payment. Meals are also assessed at 625 but watch out.

The tax must be separately stated and separately charged on all invoices bills displays or contracts except on those solely for alcoholic beverages. Or toll-free in MA 800-392-6089 Child support. Commissioners Mandate for Multiple Locations.

The tax brings the 625 percent statewide sales tax to 7 percent for. 205 x 01025 210125. Cash check or credit card pay at the Tax Collectors Office Gardner City Hall or the Kelly and Ryan Office at the MassRMV.

Professional Real Mass High Level Professional Mass Gainer

Christina S Cafe Breakfast Brunch A Food Cafe

Precision Nutrition Certification Level 1 Precision Nutrition Nutrition Certification Precision Nutrition Nutrition Blog

Inicio Tecnoeducaservicios Com Social Media Advertising Idioms Lessons Things To Sell

Mass Casual Leave Treat As Cl Fapto Picketing For Abolish Cps Scheme Casual Leave Mass Schemes

Photo Of Ming S Seafood Restaurant Malden Ma United States Seafood Restaurant Restaurant Malden

Businessman Using Mobile Phone At Work Free Image By Rawpixel Com Social Media Advertising Idioms Lessons Things To Sell

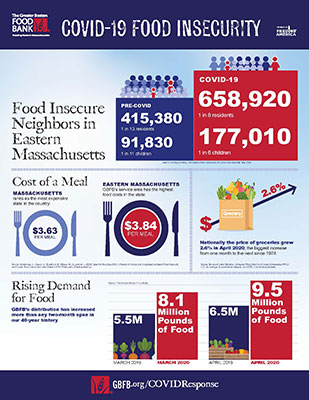

New Projections For Eastern Mass Show 59 Increase In Food Insecurity

Advance Payment Requirements Mass Gov

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Metric Units And Common Imperial Units Mass Capacity Length Conversion Year 5 6 Worksheet Only Teaching Resources Metric Conversion Chart Imperial Units Chemistry Help

Massachusetts Sales Tax Small Business Guide Truic

Department Of Public Health Mass Gov Public Health Health Department Public